Last week, I found an old $20 bill crumpled at the bottom of my sock drawer. For a second, I felt rich until I remembered the dollar's recent tumble means it’s worth less now than ever.

Turns out my neglected twenty is symbolic of a bigger trend: the US dollar just had its worst first half of the year since 1973, battered by trade wars and trillion-dollar debt deals.

Today, we’ll unpack why investors are suddenly fleeing from the once rock-solid greenback—and what it means for your investments.

Recommendations

My favorite finds

Deals

Industry News

World

Companies

Is the Dollar Losing Its Crown? What Wall Street Is Telling You

The Dollar Just Had Its Worst Start Since Disco Died

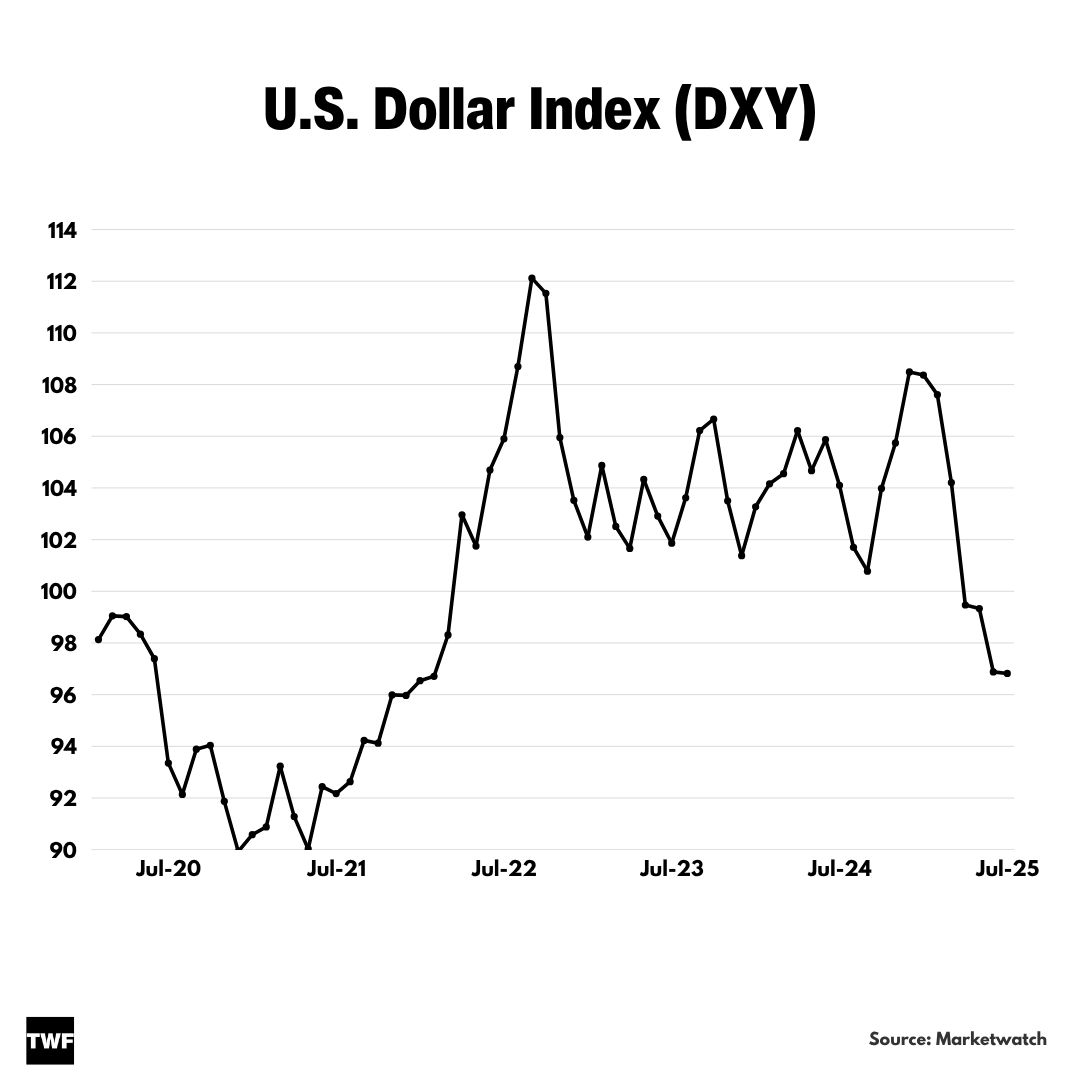

Remember bell-bottoms and disco? Well, neither does the US dollar, apparently. It just had its worst first-half performance since 1973, diving nearly 11% against a basket of currencies in a slump that left investors scrambling and central banks eyeing their vaults.

The greenback’s epic tumble isn’t just a number-cruncher’s nightmare—it's a flashing neon sign of a seismic shift in global confidence. Driven by Donald Trump’s unpredictable trade and economic maneuvers (dubbed by some as Trump 2.0), investors are rethinking their once-unshakable faith in the world’s dominant currency.

The Greenback’s Big Slide

Let’s put this into perspective. The US dollar index—which stacks the dollar against heavy hitters like the euro, pound, and yen—plunged 10.8% in just six months. That’s the steepest slide since the Nixon era when bell-bottoms were groovy, and the Bretton Woods gold standard was freshly dead.

Initially, Wall Street expected Trump’s tariffs to batter foreign markets and boost American inflation, strengthening the dollar. Instead, global investors saw through the smoke and mirrors, focusing on America’s massive borrowing spree and questioning the independence of the Fed.

From Safe Haven to Question Mark

Historically, the dollar has been investors' safety blanket during rocky economic times. But Trump's aggressive economic strategy, paired with his controversial $3.2 trillion tax bill—dubbed the “big, beautiful” tax plan—is turning that security blanket into Swiss cheese.

Worries about ballooning US debt are forcing investors to rethink their loyalty. As US borrowing skyrockets, big institutions, from pension funds to foreign central banks, are pulling back from their US dollar assets and hedging their bets elsewhere.

The Fed’s Rate-Cutting Frenzy

Another significant punch to the dollar’s gut is the Federal Reserve’s newfound dovishness. Thanks partly to Trump’s aggressive pressure, the Fed is expected to slash rates by at least five quarter-point cuts through the next year. Investors love low rates—at least, temporarily—but those lower yields are killing the dollar’s appeal.

While the S&P 500 is still riding high in dollar terms, European markets are outperforming American stocks once you account for the weaker dollar. This currency weakness means US investors abroad have seen their returns significantly diminish.

Gold Shines as Dollar Dulls

And where do jittery investors run when the dollar tumbles? Straight to gold, which just hit record highs this year as central banks and hedge funds flee the buck’s uncertainty. Nothing says fear of dollar devaluation quite like piling bars of gold in your vaults.

Gold’s gleam this year serves as a stark reminder: confidence in paper currency—no matter how green—is fragile when trust erodes.

Is This the Dollar’s New Normal?

Given how swiftly the dollar dropped, some strategists believe the worst might be behind us—for now.

Yet, while the dollar may stabilize short-term, the long-term narrative is shifting. Investors globally are re-calibrating portfolios, hedging more, and diversifying away from US assets, reflecting deep unease about America's economic leadership.

What’s Next for the Buck?

The dollar’s future largely depends on how Trump 2.0 continues his economic chess game and how aggressively the Fed moves to stave off economic turbulence. But even if the dollar stabilizes, the psychological damage is done—investors now see the world’s reserve currency through a cracked lens.

As disco taught us, even the strongest trends can vanish overnight.

See you next week,

— Matt

P.S. If you enjoy my emails, move them to your primary inbox and let me know by sending a reply or clicking the poll below. I read every response.