Happy Tuesday! Today we dive into Target's Struggles and What's Next for the Retail Giant.

Target’s rough patch

WBD’s ongoing mismanagement saga

Have something to tell us? Just hit reply - we'd love to hear from you!

Check out our sister Newsletter! Its all about Personal Finance and building wealth.

The Downfall of Target

Target's been in a bit of a rough patch lately. Walmart seems to be poaching all of the affluent customers who used to be Target's bread and butter.

Target is known for its chic, affordable in-house brands and catchy ads. Though it might be a tad pricier than its rival Walmart, the ambiance is undeniably superior. However, as inflation tightens its grip on consumers' wallets, many are beginning to reconsider whether the extra cost is truly worth it.

Target's trying to turn things around. Just recently, they announced a series of changes aimed at kickstarting growth again.

They're on the hunt for a new chief marketing officer.

Negotiated an agreement with Shopify to incorporate third-party vendors.

Currently rolling out an AI chatbot to help store clerks.

They're slashing prices on thousands of items to boost sales.

But it's been a tough year. Comparable sales have been down for four straight quarters. Executives are cautiously optimistic, predicting sales will be flat or up by 2% for the fiscal year. The decline kicked off a year ago, exacerbated by inflation, higher interest rates, and a backlash against Pride merchandise. This led to bomb threats and a significant dip in sales, particularly in the second quarter of 2023, when they saw a 5.4% drop.

Target's reliance on discretionary items like home decor and toys has made it vulnerable to economic downturns. Walmart for comparison generated generated 58.8% of its sales from groceries in 2023, Target only generated 23% of its sales from groceries during the same time period.

Target's stock hasn't kept up with the market, gaining just 2% in the past two years, while the S&P 500 and Walmart have surged. CEO Brian Cornell's growth plan includes opening over 300 new stores and remodeling hundreds more, aiming to boost sales by $15 billion over the next decade. They also plan to launch new private-label brands to attract customers looking for novelty and affordability.

Target shoppers tend to be middle or high-income, younger, female, and urban or suburban.

To make matters worse, Target's heavy reliance on in-house brands means their price cuts might hit harder than at stores where vendors share the burden. " Both Target and Walmart have been investing heavily in ecommerce, trying to compete with Amazon, which holds a commanding 40.4% share of US retail ecommerce.

Walmart's online business is moving towards profitability faster than Target's. BNP Paribas Exane, the only broker with a sell rating on Target, argues that rivals like Amazon, Walmart, and Temu pose a significant threat to Target's $106 billion in total sales.

Warner Bros Discovery's Big Breaking Up

Warner Bros Discovery, the Company that owns CNN and HBO, is contemplating a split of its digital streaming and studio businesses from its traditional television networks. This ambitious plan aims to boost its struggling share price.

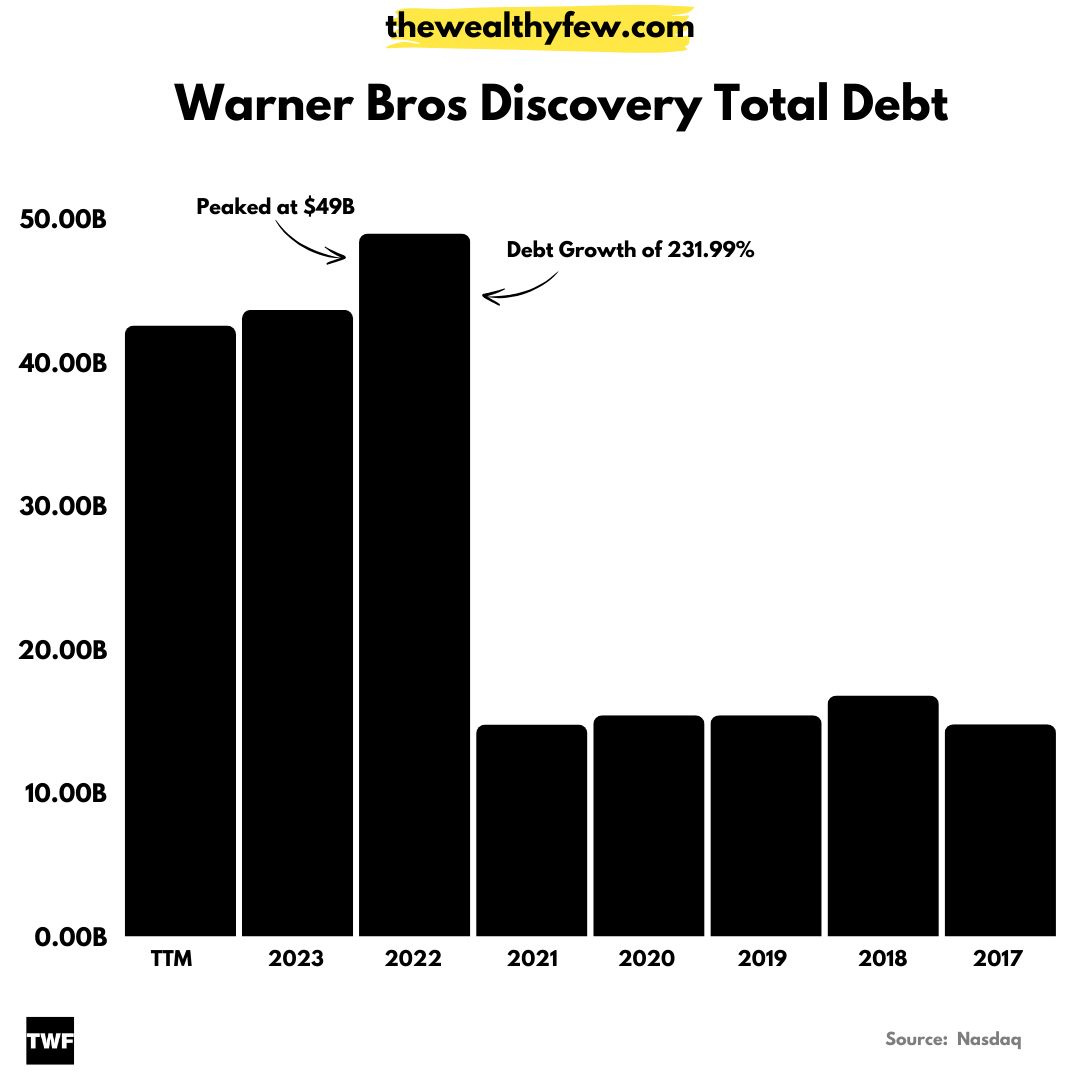

Insiders say CEO David Zaslav is exploring various options, from selling off assets to spinning off Warner Bros and the Max streaming service into a new company, free from the burden of the group's $39 billion debt.

Over the past year, WBD’s market value has plummeted by a third to around $20 billion.

WBD has reportedly reached out informally to advisers of rival media companies to gauge interest in potential mergers and acquisitions. In the past, WBD considered merging with Comcast’s NBCUniversal and Paramount. However, those discussions have cooled, particularly since Paramount agreed to sell to David Ellison’s Skydance studio.

WBD has declined to comment, but insiders believe that breaking up the company could be the most viable solution. This proposed “strategic spin-off” would create a new entity with WBD’s legacy TV assets.

Even though these assets have seen better days revenue-wise, they still bring in a good chunk of cash. Meanwhile, the leaner streaming and studio business would be free to innovate and grow without being weighed down by debt.

Since AT&T spun off Warner Bros and merged it with Discovery two years ago, WBD’s shares have nosedived by about 70%. The company has been battered by a weak advertising market, the high costs of developing its streaming services, the Covid-19 pandemic, Hollywood strikes, and some pretty expensive flops.

Despite efforts to trim costs and pay down debt, WBD’s stock took a 10% hit in February when the CFO couldn’t provide projections for free cash flow this year. That’s a tough pill to swallow!

Now, if WBD does go for the split, it could get a bit tricky. We’d be looking at two separate companies needing to hash out terms for sharing sports rights and other content currently spread across both digital and traditional TV platforms.

Headline Roundup

Not a subscriber? Sign up for free below.

Check out our sister Newsletter! Its all about Personal Finance and building wealth.

DISCLAIMER: None of this is financial advice. This newsletter should be used for discussion, education, and illustrative purposes only and should not be construed as professional financial advice, solicitation, or recommendation