Soho House built a global empire on one simple principle: the velvet rope. For nearly three decades, its business was deciding who was in and who was out. In 2021, it threw open the doors to the most public club in the world: the New York Stock Exchange.

Turns out, Wall Street wasn't impressed.

After three tumultuous years, a plummeting stock price, and a takedown from a short-seller, the "public house" experiment is officially dead. The company is being taken private in a $2.7B deal that values it far below its $14 IPO price. So how did one of the world's coolest brands become such a Wall Street flop?

Recommendations

My favorite finds

Deals

SoftBank Invests $2 Billion in Intel as U.S. Considers Taking 10% Stake in Chip Maker

Industry News

Home Depot will raise prices on some items due to tariffs, reversing an earlier position.

World

US Soybean Farmers Near ‘Financial Precipice’ Due to Tariffs

Companies

Soho House's $2.7B Escape Plan

There’s a beautiful irony in the story of Soho House.

For nearly 30 years, the company built a global empire by perfecting the art of the velvet rope. Its entire brand was an exercise in carefully managed scarcity — creating exclusive clubhouses for "creatives" and making everyone else desperately wish they could get in.

Then, in 2021, the ultimate gatekeeper of cool threw open its doors to the most public, un-curated place on Earth: the New York Stock Exchange.

For four shaky years, the physical embodiment of exclusivity tried to play by the rules of mass accessibility. It did not go well.

Now, in a dramatic reversal, Soho House is orchestrating a $2.7B deal to do what it should have done all along: get back behind the rope. This take-private transaction isn't just a financial maneuver; it's a strategic retreat. It's an admission that you can't put a stock ticker on a vibe.

This is the cautionary tale of what happens when a private club is forced to act like a public utility.

The Curse of Being Too Cool

When Soho House went public in July 2021, it did so under the painfully corporate name "Membership Collective Group" — a name that already hinted at an identity crisis.

The IPO raised $420M with shares priced at $14 a pop, valuing the company at a cool $2.8B. For a moment, it seemed the creative class had conquered Wall Street.

That moment was brief.

The market, it turns out, cares less about cultural capital and more about old-fashioned things like profit. The stock began a long, painful slide. By the time the take-private deal was announced, shares were languishing around $7.60, a brutal ~46% decline from its debut.

Wall Street rewards predictability and relentless expansion — a model that works great for Marriott, which can stamp out identical rooms from Des Moines to Dubai. But Soho House was selling the opposite: uniqueness, character, and the feeling that you were somewhere special.

As the company struggled to translate "specialness" into quarterly earnings reports, investors fled.

TGI Fridays with more laptops

To justify its public valuation, Soho House had to grow. That meant one thing: more members. Lots more.

The result was predictable. The once-exclusive havens became chaotic and overcrowded. Members paying up to $5,000 a year found themselves unable to get a seat at the bar.

The vibe shifted from a relaxed "home for creatives" to something far less desirable.

The problem got so bad that in late 2023, founder Nick Jones sent an email to members announcing a drastic step: Soho House would stop accepting new members in its most important markets — London, New York, and Los Angeles.

It was a stunning admission. The company whose entire business model was selling memberships was now refusing to sell them because its own product had been degraded by its success.

How can you promise infinite growth to shareholders while promising finite capacity to members? You can't.

The 28-Year-Old Startup

The bombshell that really rocked the boat dropped in February 2024.

GlassHouse Research, a New York-based short-seller, released a scathing report that compared Soho House to the spectacularly failed WeWork and slapped a $0 price target on the stock. 😬

GlassHouse accused the company of having a "broken business model," arguing it had never been profitable in its 28-year history and had only gone public to "dump on retail investors" while its debt surged.

The core of the argument was the company's self-destructive growth strategy. To appease Wall Street, Soho House was expanding into "less affluent cities." The logic was devastatingly simple: If you can't make a profit in New York and London, how do you expect to make one in Portland or São Paulo?

The pressure to grow for the public market was forcing the company into a vicious cycle:

Overcrowd prime locations to boost numbers.

Ruin the vibe, forcing a membership freeze.

To show growth, expand into secondary markets.

Dilute the brand's exclusive, global appeal.

The company was trapped. The only way out was to get off the public market treadmill entirely.

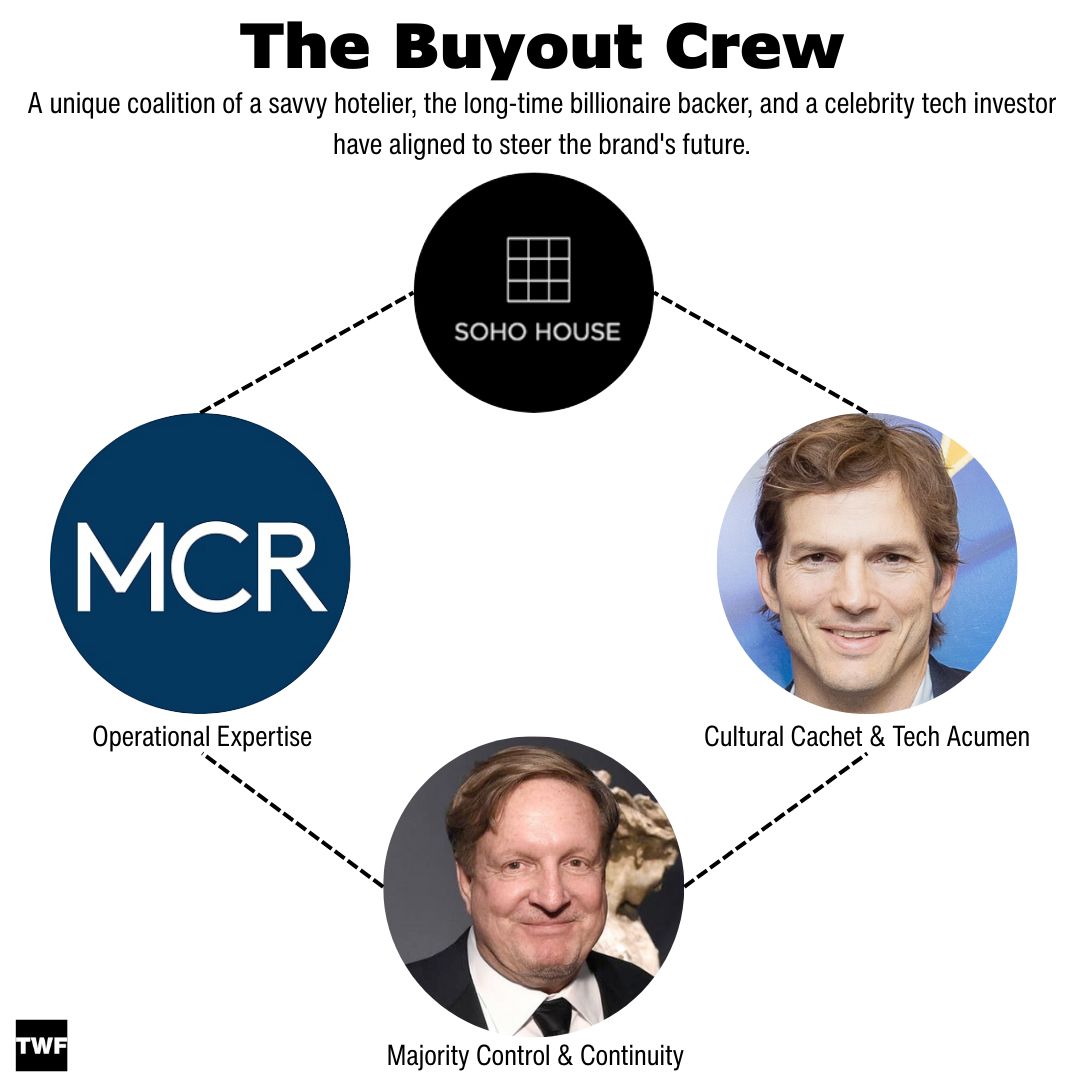

The Buyout Crew

So, who’s footing the $2.7B bill to fix this mess? It’s a fascinating cast of characters.

The Custodian: MCR Hotels. The lead buyer is the 3rd-largest hotel owner-operator in the US. Their crown jewel is the TWA Hotel at JFK Airport, a painstaking restoration of the iconic 1962 flight center. These guys know how to preserve a vibe.

The Old Guard: Ron Burkle. The billionaire investor who has been Soho House's primary backer for over a decade will roll over his stake and retain majority control.

The Agitator: Dan Loeb. The formidable activist investor and founder of hedge fund Third Point, blasted the initial deal talks as a "sweetheart deal" for Burkle, forcing a more transparent process that likely got other shareholders a better price.

The Wild Card: Ashton Kutcher. The actor-turned-successful tech investor is part of the buying group and is set to join the board of directors. This is a strategic masterstroke, re-anchoring the brand in the world of modern creativity and tech it was founded to serve.

Here’s how the deal breaks down:

The Big Picture: Buying Back the Vibe

The single greatest advantage of this deal is escaping the tyranny of the quarterly earnings report.

Freed from the relentless pressure to show short-term growth, management can finally make long-term investments in the member experience. The plan is to focus on "sustainable international growth," which is corporate-speak for "we can finally focus on being cool again."

But the big question remains: Can the magic truly be restored?

The brand has been damaged. The perception of exclusivity has been tarnished. The new leadership — a mix of the old guard (Burkle) and new blood (MCR, Kutcher) — will have to navigate this tension carefully.

The Soho House experiment is a business school case study written in real time. It proves that the logic of Wall Street — relentless, homogenizing growth — can be toxic to a business built on the opposite principle of curated differentiation.

The public market might offer a flood of capital, but it could demand your soul in return. For Soho House, the cost of buying it back is $2.7B.

Community

Open Forum

Aravind has the most savage exit interview of all time.

Have a Question? Let's Hear It!

I love building this newsletter with you in mind, and my favorite part is hearing from you directly.

Have a burning question, a great idea, or a thought you'd like to share? Send it my way! I'll pick some of our favorite submissions to answer and feature in next week's edition.

P.S. I read every single submission! Let me know if you'd prefer to remain anonymous.

See you next week,

— Matt

P.S. If you enjoy my emails, move’ them to your primary inbox and let me know by sending a reply or clicking the poll below. I read every response.