For millions of runners and cyclists, Strava and Garmin are Mom and Dad. One provides the rugged, reliable hardware (the watch), and the other provides the community, the validation, and the social clout. For years, they’ve coexisted in a symbiotic, if sometimes tense, marriage.

But now, Mom and Dad are fighting. And as Strava, the $2.2B social darling, prepares to go public, their spat over logos and patents is threatening to become a very messy, and very public, divorce.

My favorite finds

World

Companies

Markets

STRAVA’S Big Run

For millions of runners, Strava and Garmin have been the ultimate fitness power couple — one logs the miles, the other logs the kudos.

So when a public spat erupted between them this fall, it felt like “Mom and Dad are fighting.”

And the timing? Awkward.

Strava’s CEO just confirmed plans to take the company public to fund “more and bigger acquisitions,” even as the beloved exercise-tracking app finds itself in a high-stakes tiff with its longtime partner-in-cardio, Garmin.

RUNNING ON AN UPWARD TREND

Strava is riding a wave of pandemic-era fitness enthusiasm.

The 16-year-old app — which turns workouts into social posts — has seen its user base explode to ~50 million monthly active users in 2025, nearly double Garmin’s.

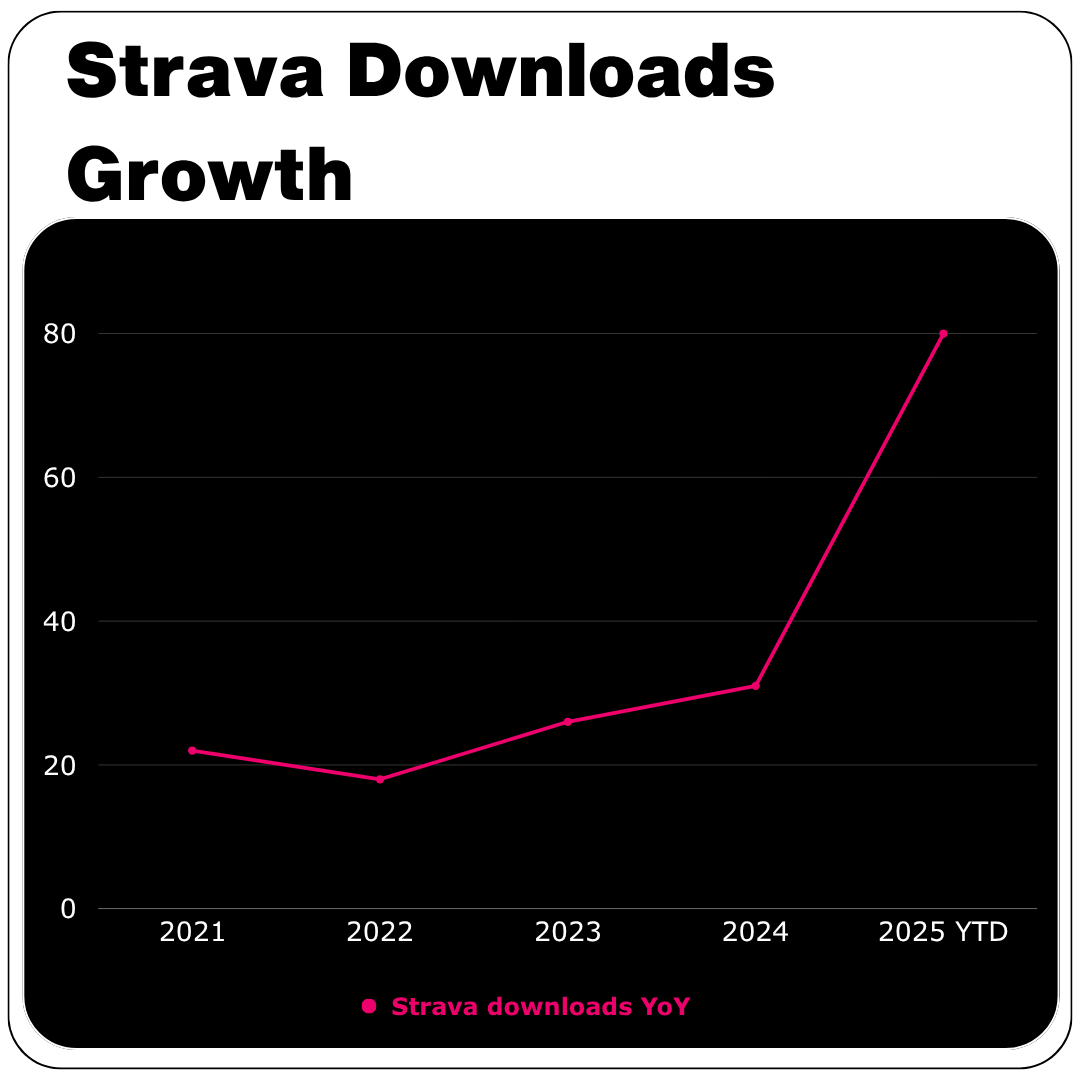

Growth stats:

Downloads up 80% YoY

1.1 million applied for the 2026 London Marathon (+31%)

200,000+ applied for NYC Marathon (+22%)

“Growth profiles like ours… are particularly uncommon, especially at scale,” CEO Michael Martin said.

Unlike Nike or Adidas’s apps, Strava wins through community — giving kudos, comparing splits, and sharing the grind.

BY THE NUMBERS

Metric | 2025 Value |

|---|---|

Valuation | $2.2 B (Sequoia-backed) |

Monthly Active Users | 50 M |

Downloads Growth | +80% YoY |

Premium Spend | $180 M+ / yr |

Premium ($11.99/mo or $79.99/yr) remains Strava’s core revenue driver, supplemented by brand partnerships and sponsored challenges.

ACQUISITIONS ON THE MOVE

Strava recently snapped up:

🏃 Runna (UK) — personalized coaching

🚴 The Breakaway — cycling training

Both fix a long-standing weakness: custom training plans.

Martin, a former Nike exec, has doubled down on features that convert free users into paying subscribers — shifting growth from “get more users” to “make each user worth more.”

A BUMPY PATCH WITH GARMIN

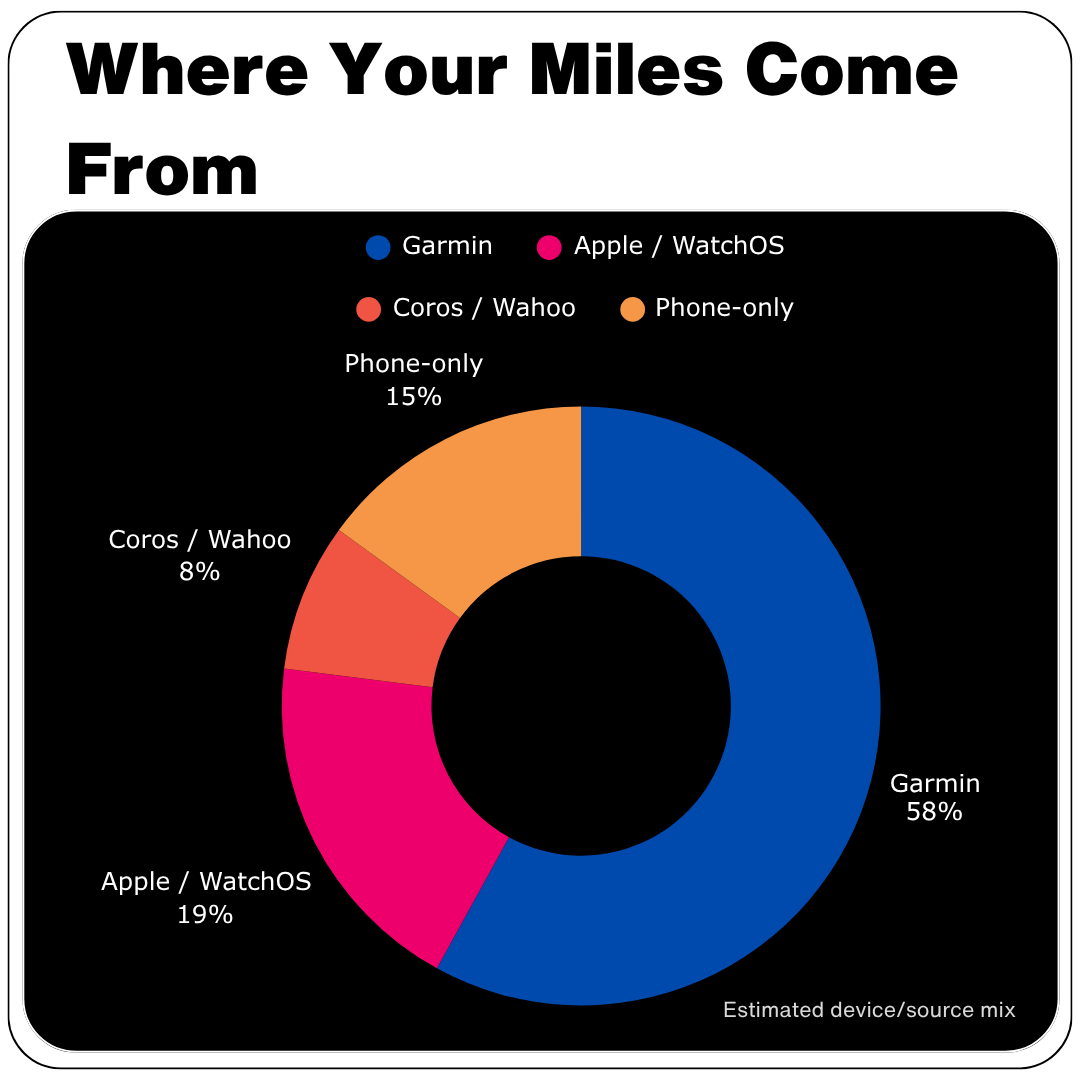

For years, Strava and Garmin were inseparable — Garmin tracked your data, Strava made it social.

Now, the two fitness titans are at war over logos, data, and control.

📍 The dispute:

Garmin’s new developer rules require Strava to show a Garmin logo on all workouts recorded with Garmin devices.

Strava called it “blatant advertising” that “degrades the user experience.”

Garmin’s ultimatum: comply by Nov 1 or lose data-sharing access.

“I’ve got my thousand-dollar watch and my $80 app — can we just get a family meeting and start getting along again?”

Strava’s response? Sue them.

The company filed a patent-infringement lawsuit, accusing Garmin of copying its segments and heat maps and breaking a previous cooperation deal.

Runners online dubbed it “the divorce no one wanted.”

THE ROAD AHEAD

As Strava gears up for its IPO, it faces the classic dilemma:

Can it scale without losing its soul?

The app is now “more than mainstream,” as one running-club leader put it — “almost as important to running as shoes.”

But saturation looms. Future growth depends on:

Elevating Premium features 🏆

Retaining community trust 🤝

Repairing the Garmin relationship ⚙️

If Strava can keep its runners, rivals, and investors in stride, its next finish line won’t be a marathon — it’ll be Wall Street.

QUICK TAKEAWAYS

Strava IPO prep underway

50 M monthly users; 80% YoY download growth

$180 M+ in annual subscription spend

Garmin demands logo placement → Strava sues

Success depends on community + Premium upsell

Have a Question? Let's Hear It!

I love building this newsletter with you in mind, and my favorite part is hearing from you directly.

Have a burning question, a great idea, or a thought you'd like to share? Send it my way! I'll pick some of our favorite submissions to answer and feature in next week's edition.

P.S. I read every single submission! Let me know if you'd prefer to remain anonymous.

In Case You Missed It…

The business of building a bubble: On the surface, the AI revolution runs on silicon chips and brilliant code. But dig a little deeper, and you’ll find its true fuel source.

Why EA is cashing out for $55B right before its biggest launch in years: With its highly-anticipated “Battlefield 6” looking like a sure winner, the company just folded its public hand for $55B…. but why?

Soho House’s public market experiment is over. It didn't go well: After three tumultuous years, a plummeting stock price, and a takedown from a short-seller, the "public house" experiment is officially dead.

See you next week,

If you enjoy my emails, move them to your primary inbox and let me know by sending a reply or clicking the poll below. I read every response.